This article was originally published on WLT Report. You can read the original article HERE

Do you think $750 BILLION in losses might be a bad thing for the economy?

Of course I ask that firmly tongue-in-cheek because we all know that will be devastating.

But that’s exactly what’s right around the corner.

Allow me to explain in plain English so I can make it really simple for everyone to understand what’s coming and what it hasn’t already hit us just yet….

I’ll try to make this super easy to understand because I know finance and economics can sometimes be a confusing topic.

But trust me when I tell you this is extremely relevant to your life and to the next few years America is about to go through.

It all starts with interest rates, simple right?

Rates were low for many years and so investors and in particular real estate investors borrowed as much money as they could!

At low rates, almost any deal worked and made money.

And with rates being low for so long, many NEW real estate investors had never lived through an economy with higher interest rates, and even seasoned investors believed rates would never go back up that high — or if they did, it certainly wouldn’t be quick.

But here’s what most people may not realize….unlike your home mortgage which is most commonly a 30-year loan, that’s not how most real estate loans work.

You see, the banks don’t like to get locked into that long of risk, so commercial real estate loans are much more commonly 3, 5 or 10 years only, and they typically have a 25 or 30 year amortization schedule on them.

You don’t need to understand how all of that works, all you need to understand is that real estate investors often need to refinance every 3 or 5 years, meaning your deal might have worked great at 3% interest but what happens when you suddenly need to refinance and rates are now 7 or 8%?

And you still have a huge chunk still unpaid because of that longer term amortization (called a “balloon payment”).

Worse yet, some investors did what’s called “interest only loans” and they haven’t paid anything back at all, and they are likely going from a 3% interest rate to an 8% interest rate.

Without going into all the details of how the math works, the bottom line is this: a deal that worked and cash-flowed at 3% is likely upside down at 8%.

Does it all make sense now?

Why didn’t the market crash when rates shot up so fast?

Because real estate investors were still locked into those 3, 5 and 10 year loans.

But guess when those are coming due for refinancing?

Soon.

Now.

And that’s where the $750 billion in losses comes from.

So with all of that understanding under our belts, now let me back up everything I just told you.

Here is Kirk Elliott, PhD on with Alex Jones explaining exactly what I just told you.

This is fascinating, I think you’re really going to enjoy this and I think it will connect a lot of dots for you:

BREAKING: Federal Regulators Are Preparing For Massive US Bank Failures As 750 Billion In Losses Is Now Due@kirkelliottphd pic.twitter.com/76yimCOx4x

— Alex Jones (@RealAlexJones) October 31, 2024

If you’d prefer something a little more simple and shorter, watch this instead:

🚨BREAKING NEWS 🚨

US BANK CRISIS CONTINUES with over $750 BILLION IN LOSSES from real estate debt.

That’s SEVEN times higher than the unrealized losses reported in 2008 threatening our entire financial system.

Full details below ⬇️ pic.twitter.com/ibXR2Y6sU9

— Taylor Kenney (@itmtaylorkenney) October 28, 2024

YahooNews/Benzinga has more details:

The 2008 financial crisis exposed numerous flaws in America’s financial system, such as the inherent danger of America’s largest banks being overleveraged. Significant dangers remain despite a slate of reforms designed to keep banks on sound financial footing going forward. A recent article in Cryptopolitan magazine revealed that American banks’ potential loss exposure on real estate-related securities skyrocketed to $750 billion in Q3 2024.

This is raising concerns for many reasons. First, the estimated $750 billion is roughly seven times more than banks held in 2008. Second, many unrealized losses are concentrated in portfolios that are crucial to bank profits. The most at-risk portfolios are:

· AFS-Available for sale

· HTM-Held to maturity

One deeply troubling aspect of the potential $750 billion in losses is that so much is tied to residential mortgage-backed securities (RMBS). Banks loaded up on these when interest rates were lower. The easy credit made it easier for banks to acquire larger debt tranches and the underlying assets were also easier to sell. Making such heavy investments in RMBS now threatens to boomerang back on banks and investors in a big way.

Many of those HTM portfolio loans are approaching maturity dates and high interest rates are slowing sales down in the AFS portfolios. That’s why the potential losses are beginning to stack up. Increased financing costs are consuming massive chunks of what used to be profit and Investors are wary of buying RMBS in the current environment.

This decreases the value of bank-held RMBS while increasing the potential losses on the underlying assets. Being upside down on large AFS or HTM portfolios has taken banks down. In 2023, unrealized losses on First Republic Bank’s commercial loan portfolios were a major contributor to the bank’s eventual collapse and takeover by JP Morgan Chase.

Banks may have been able to carry these balances in years past, but one of the major reforms instituted after 2008 is making that much more difficult. U.S. banks must submit to periodic “stress tests” where their liquidity is weighed against outstanding debt and liabilities. If those numbers are out of line, the bank could be forced to close or make major markdowns.

If that wasn’t enough, banks have more potential for major losses in other areas, specifically in treasury and corporate bonds. Cryptopolitan cited Bank of America’s recent admission that it lost $85 billion in its bond portfolio this year. Worse still, Bank of America has taken a $116 billion hit to its HTM portfolio in the last three years. They are not alone.

According to Cryptopolitan’s research and public filings, 47 of the 1,027 American banks with assets over $1 billion have potential liabilities and losses on their books totaling more than 50% of the bank’s capital equity. At the moment, it’s important to stress that these are unrealized losses, which means that the banks holding the paper aren’t necessarily going to lose it, but that they could.

If the worst-case scenario came to pass, the banking industry and the economy would be in crisis. That said, the future is difficult to predict and much of what happens next will depend on what the Federal Reserve does with interest rates going forward. If rates remain steady or continue falling, some analysts believe that banks may be able to cut their unrealized losses by up to 25%.

That would knock billions of these unrealized losses off the books. On the other hand, if interest rates go back up, the long-term outlook could change for the worse very rapidly. In either case, anyone invested in RMBS or big bank shares should watch this sector carefully over the next 18 months. They could be in for a very bumpy ride.

The EconomicTimes calls it another 2008 in the making:

The US banks have never been this volatile in previous years, other than the 2008 financial crisis, where the financial pillars faced a massive issue, even verging on the point of crashing down. Meanwhile, things could down the similar line under recent circumstances as there are losses reported in realty debt-related securities, amounting to a whopping $750 billion. Even though there are multiple safety valves in place by the Fed at this point, that may still not be enough to prevent a financial crisis if various market factors keep mounting due pressure, with the US elections’ uncertainty taking the primary lead in this issue.

Bank losses mounting, US economy could be in crisis

The reported losses of $750 billion is roughly whopping seven times more than banks held in 2008. There are many unrealized losses also doing the rounds, which are very important for reporting bank profits. Even though banks have been able to subside similar issues in the past, but there is no saying as to what might happen this time if this loss-making spree continues over time. One of those banks spearheading this crisis is Bank of America, which has undertaken a $116 billion hit to its HTM portfolio in the past three years, which is a whopping figure as far as losses go.If the worst-case scenario arrives for the US banks in the coming days, the US economy could be at a major risk, and would solely depend on what calls the US Federal Reserve takes on handling the crisis, primarily revolving around interest rates.

So….what can you do?

Even if you’re not a real estate investor, how do you avoid getting drug down with the entire economy when it crashes?

Read these three reports:

As Gold Prices Hit New Record Highs, One 12-Page Guidebook Lays Out The Plain Facts For Investing

Incoming Return To Gold Standard To Shock The World (and Wipe Out Many Americans)? READ THIS!

Here’s What I Told a Family Member Who Asked If He Should Buy More Gold Right Now

Here's What I Told a Family Member Who Asked If He Should Buy More Gold Right Now

Want to get find out how you can get Gold and Silver with NO MONEY out of pocket? I'll tell you in this article, keep reading!

Recently, a family member called me up to ask what I thought about buying more Gold and Silver right now.

Since I've been preaching about Gold and Silver for a while now, and since that preaching has been proven to be right as Gold and Silver at creating new all-time highs on a nearly daily basis, I guess I've gained a bit of a reputation for being "the Gold guy".

But I was happy to have the conversation and honored to have been asked my opinion.

I've actually received the same question from many of you by email, so I thought I'd go ahead and share what I told my family member with all of you!

Sound good?

Ok, so the first thing I told him was what I would tell all of you: I'm not a financial advisor and I can't give anyone personalized financial advice. Not even a family member and definitely not any of you reading this. I'm just a reporter who reports on the political and financial news and someone who notices trends and reports on where I see things going.

So that's the first thing.

But I can tell you what makes sense to me and what I'm doing, so beyond that, I told him that what I would tell anyone in general is you never want to buy any investment with money you need to maintain your daily lifestyle. That's first and foremost.

Investments are generally a good thing, especially protective investments that will do well when everything else is going down, but you never want to put yourself in a situation where you don't have enough cash or cash flow on hand to cover your basic living expenses and maintain your current lifestyle.

So that's where we start, let's get over that hurdle first.

Second, Gold and Silver are not "cash flowing" assets, meaning they do not kick off any monthly or quarterly cash flow the way something like real estate or dividend stocks or even municipal bonds might do.

So you're not buying Gold and Silver because you need a monthly "cash flow" check to arrive in the mailbox each month, let's just be clear on that too.

Third, let's say you've checked all the boxes so far...why would you want to buy Gold and Silver right now?

I love the way this guy put it....this is legendary investor Rick Rule who has one of the best quotes on Gold and Silver I have ever heard in the beginning of this video below.

He says: "I don't own Gold because I think it's going to go from $2,400 to $2,700....I own Gold because I'm AFRAID it will go to $9,000 or $10,000!"

Let that sink in a little bit....

Gold and Silver are not assets you're necessary buying because you think they're going to go up 10% over 5 years.

No, they are SAFE HAVEN assets that could one day jump up to $10,000/ounce in the midst of a crashing US Dollar and crashing US stock market and economy.

So if you're afraid that the US stock market is at all time highs and may soon be in for a nasty correction, or that the US dollar might soon crash as Bo Polny keeps telling us, then Gold and Silver would be serious protections to you and your family.

That's exactly why according to the new Basel III banking standards, Gold was recently reclassified as the ONLY other "Tier 1 Risk Free Asset" other than cash and treasury bonds....

Wow!

More on that here:

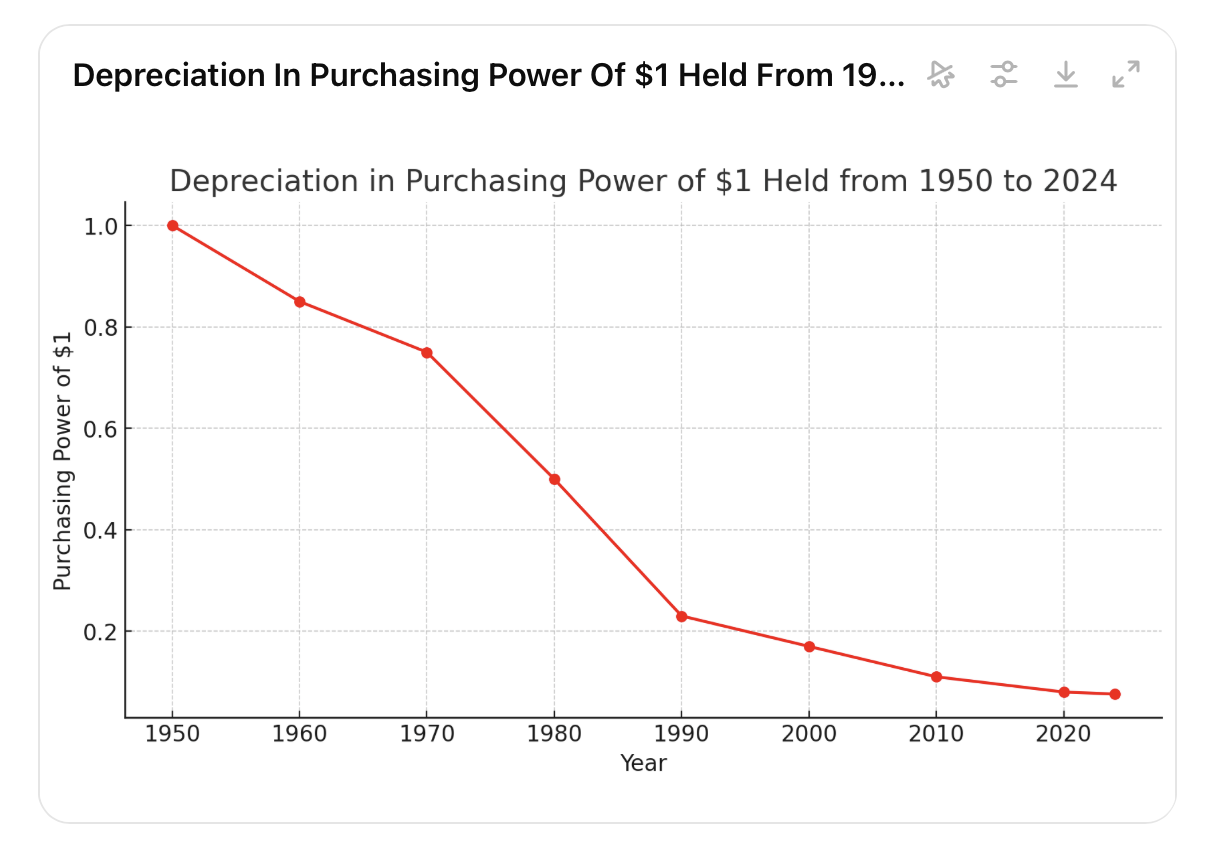

As for me personally, my goal at all times is to hold as FEW US Dollars as possible because you are literally LOSING money if you just hold dollars.

Did you know that?

Even if inflation is only at 2% (the stated goal of the FED, but it's actually much higher) you are LOSING 2% of your money every single year just holding dollars. Their purchasing power goes down 2% each year, and if you know anything about compounding interest, that starts to add up fast.

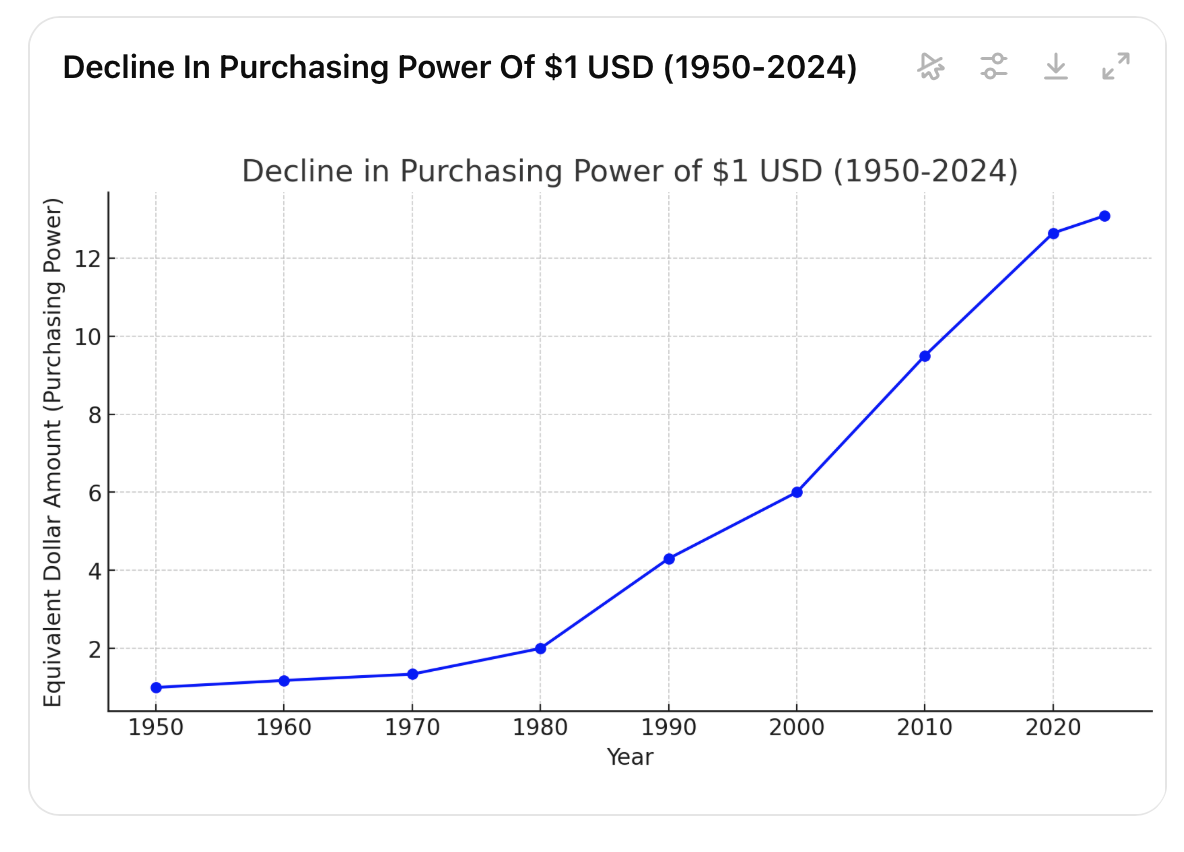

For all the visual learners out there, this might blow your mind...

Let's say you had $1 in 1950....you could purchase $1 worth of goods. Simple, right?

Now let's say you kept your money in US Dollars all these years because we were all told to "save your money! Put it in a savings bank!" right? Were you told that?

Let's say you did, how many Dollars would you need in 2024 to buy the same thing based on historical inflation rates?

You would need $13 to buy the same thing!

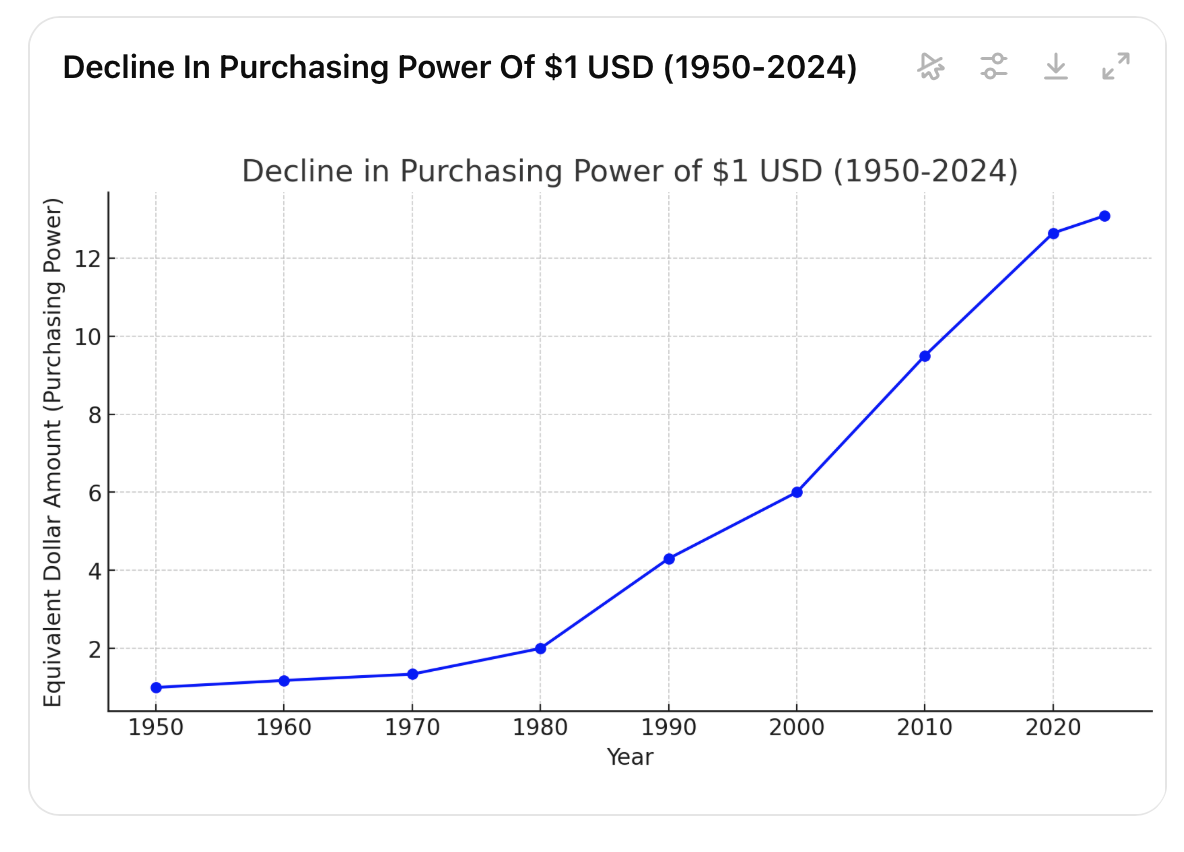

I actually think the more powerful way to look at it is the reverse, so I like this chart better...

Let's say you had that same $1 from 1950 and you were a good boy or good girl and saved it in your savings account at the bank just like they told you to do....

How much could you buy with that $1 in 2024?

Only 7.6 cents worth!

$1 in 1950 turns into only $0.076 in 2024 thanks to inflation! Wow!!

That's why I personally try to get as much of my money OUT of US Dollars and into other assets that will tend to hold their value over a long enough time.

For me, that means Gold, Silver and Crypto.

Another great option is Real Estate, it's just a lot harder to get into.

I like how I can buy smaller batches of Gold, Silver and Crypto whenever I want to.

So that's what I told my family member:

- I can't give you personalized financial advice.

- Make sure you don't buy any investment with money you need to live on.

- Don't buy Gold or Silver if you need something that provides "cash flow".

- But if you can check off all those boxes, and you don't want to see your $1 turn into $0.076, it might be a very smart idea to park your money in Gold and Silver!

Every person's situation is different and I always encourage you consult with your own personal financial advisor if you have one.

But if you NEED an advisor or need some help getting started, I'd like to introduce you to my friend Ira Bershatsky...and I'd like to tell you about a little secret -- how you can get Gold and Silver with NO MONEY OUT OF POCKET! Yes, really. Keep reading...

Meet my friend Ira, with Advisor Metals, custom link for all WLT Report readers right here: WLT Precious Metals.

Speaking of family members, I have personally sent family members to Ira for 5-figure purchases of Gold and Silver and he treated them like royalty. They were very pleased.

That's how much I trust Ira.

I didn't tell him I was sending them over either (and these particular family members have a different last name) so I did it as a bit of a "secret shopper" test and Ira passed with flying colors.

Of course I knew he would.

That's why I work with him and that's why I have confidence telling you about him.

Ira can handle bulk purchases of bullion, coins, whatever you want....as well as purchasing in an Ira (more on that in a minute).

All custom ordered and shipped right to your door.

A lot of people love Bullion because it's the cheapest and most economical way to do it, to stretch your dollar into as much gold and silver as possible.

Ira's company is Advisor Metals and they have DECADES of experience helping people buy Gold and Silver. Ira has set up a custom website is called WLT Precious Metals to make sure he takes EXTRA good care of our readers.

You'll get a personal phone call with Ira Bershatsky (or someone on his team) and they will work with you free of charge for as long as needed to answer any questions you have and get you taken care of.

How about that!

You don't see that much anymore, but Ira and his team pride themselves on good old-fashioned real customers service:

No sales pitch, just real, actual help.

And the best prices you will find.

There's a reason I like partnering up with Ira, and it's because of his unique experience and pedigree in this business:

Ira Bershatsky is the Managing Member and owner of Advisor Metals.

Ira has an MBA in Finance and 44 years of business experience including three decades as an institutional equity trader, compliance officer, technical chart analyst, and eight years in physical precious metals.

He is the only person in the physical precious metals industry who has the Commodities Futures Trading Commission (CFTC) Federal registration, which he has had since 1991.

What this means for you, the customer, is that everything Ira or a member of his team says to you has to be factual, there is no sales pitch or bait and switch, there are ethical considerations they have to meet, and there has to be full transparency.

Here's the only disclaimer I will give you: because they do pride themselves on dedicated service, it might take a few days before you get a phone call back. And we are experiencing a record number of new calls right now. Just be patient please.

Good things come to those who wait!

You can contact Ira and WLT Precious Metals here.

Now I promised you I would tell you about how Ira can help you get Gold and Silver with NO MONEY OUT OF POCKET, and I'm going to do that right now.

This isn't for everyone, but it is for the majority of you reading this (and you might not even realize it).

Many of you have retirement accounts that you've built up over the years at your jobs and they're loaded up with stocks and bonds.

If you'd prefer to move some or all of the money you currently have in stocks or bonds in a retirement account into a "Tier 1 Risk Free Asset" like Gold and Silver, Ira can also help you with that! It's 100% legal to purchase Gold and Silver in your IRA and you can often do so with no money out of pocket! The money is already in your IRA, we just move it into Gold and Silver. But you do need a trusted advisor to make it happen, and of course there are certain guidelines to follow, so that's where Ira comes in.

I mean, his name is Ira, after all, OF COURSE he can help you purchase precious metals in your IRA account!

Again, I'm not your personalized financial advisor, I'm just explaining how it works.

And I think it's REALLY cool.

So even if you're saying times are tough right now, I don't have a lot of spare money to shift into Gold and Silver, you might have a golden opportunity (pun intended!) already sitting there in an established retirement account.

If you'd like to see if you qualify or if you just have some questions, contact Ira here and you can get started for free, no obligation of any kind:

I've proudly sent family members to Ira and I am proud to send anyone reading this as well.

He'll take good care of you!

Cheers!

Noah

This article was originally published by WLT Report. We only curate news from sources that align with the core values of our intended conservative audience. If you like the news you read here we encourage you to utilize the original sources for even more great news and opinions you can trust!

Comments